Ways to save money

We all want to save money, but sometimes it can seem like a difficult task. Fortunately, there are several ways to save that are easy to follow.

In this article, you will learn some simple but effective strategies to start saving money today. So, get ready to take control of your finances and achieve your savings goals!

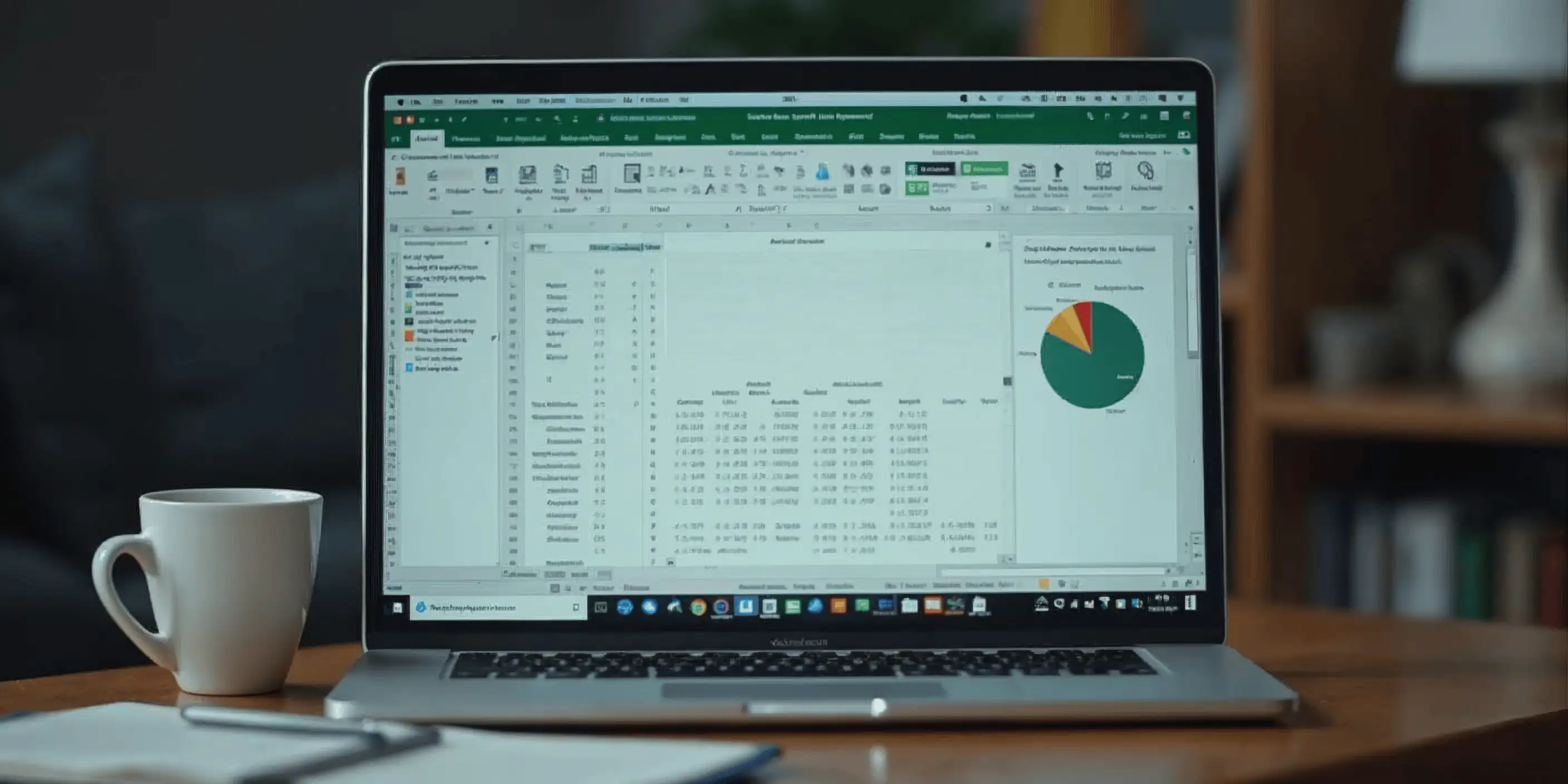

The 50/30/20 rule

One of the most popular ways to save is to follow the 50/30/20 rule. This rule basically suggests that 50% of your income should go towards essential expenses, such as rent, food, and utilities. 30% should be reserved for personal expenses, such as dining out or leisure activities, while the remaining 20% goes towards savings.

Following this rule will help you structure your expenses in a balanced way and prioritize saving each month. You can adjust the percentages according to your needs and personal goals, but the main idea is to allocate a portion of your income for regular savings.

In addition to the 50/30/20 rule, there are other strategies you can implement to maximize your savings. One option is to reduce your fixed expenses, such as renegotiating your rental contract or looking for cheaper alternatives for your utilities. You can also consider generating additional income through side activities, such as selling handmade products or providing freelance services.

Another way to save is by setting clear and realistic goals. Define short- and long-term objectives. term, such as saving for a trip or buying a house. Setting goals will give you motivation and help you keep focus on your savings.

Also, it's important to keep a detailed record of your expenses. You can use apps or online tools to track your income and expenses. This will allow you to identify areas where you can cut costs and give you a clear view of your consumption habits.

Use rounding up savings

Another smart way to save is to take advantage of automatic rounding in your purchases. Many apps and banks offer this feature, which automatically rounds up your transactions to the nearest whole number and deposits the difference into a savings account. For example, if you spend 4.70 euros, it will be rounded up to 5 euros and the remaining 30 cents will be automatically saved.

This strategy may seem insignificant in each transaction, but over time, those small accumulated amounts can turn into significant savings.

Take advantage of interest from deposits and/or paid accounts

If you have a sum of money saved and do not plan to use it in the short term, consider depositing it into a paid account or a fixed-term deposit. These options allow you to earn interest on your balance, which can steadily increase your savings.

Research different options and choose the product that offers you the most favorable conditions. Remember that interest rates can vary, so it's important to choose an option with a competitive rate even though many deposits and paid accounts currently offer low rates. They offer interests above 2%.

In addition to deposits and remunerated accounts, there are other alternatives to take advantage of the interest on your savings. A popular option is to invest in investment funds, where your money is combined with that of other investors and invested in a diversified portfolio of assets. This allows you to potentially obtain higher returns, although it also implies a greater risk.

Another option is to invest in government bonds or corporate bonds. These financial instruments allow you to lend money to an entity and receive interest in return. Government bonds are generally considered safer, as they are backed by the government, while corporate bonds can offer higher returns, but also involve greater risk.

Choosing subscriptions you're going to use

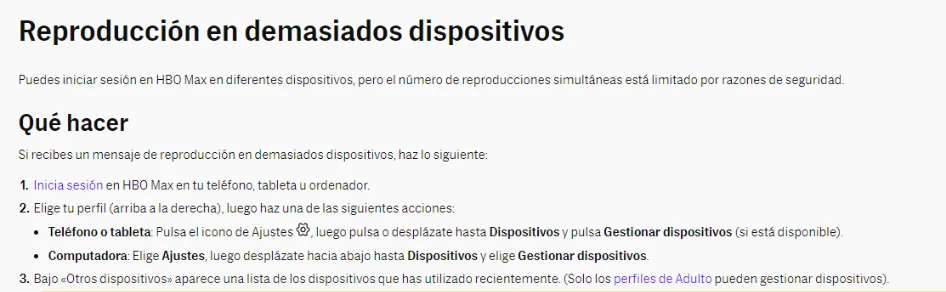

Nowadays, it's common to have several subscriptions to different services. It can be tempting to subscribe to all sorts of streaming platforms, digital magazines, and apps. However, if you don't use all these subscriptions regularly, you're paying for services that don't really benefit you.

Review your current subscriptions and cancel those that you don't frequently use. You may find that you're paying for services that you don't even remember signing up for. By eliminating these unnecessary subscriptions, you can save a significant amount of money each month.

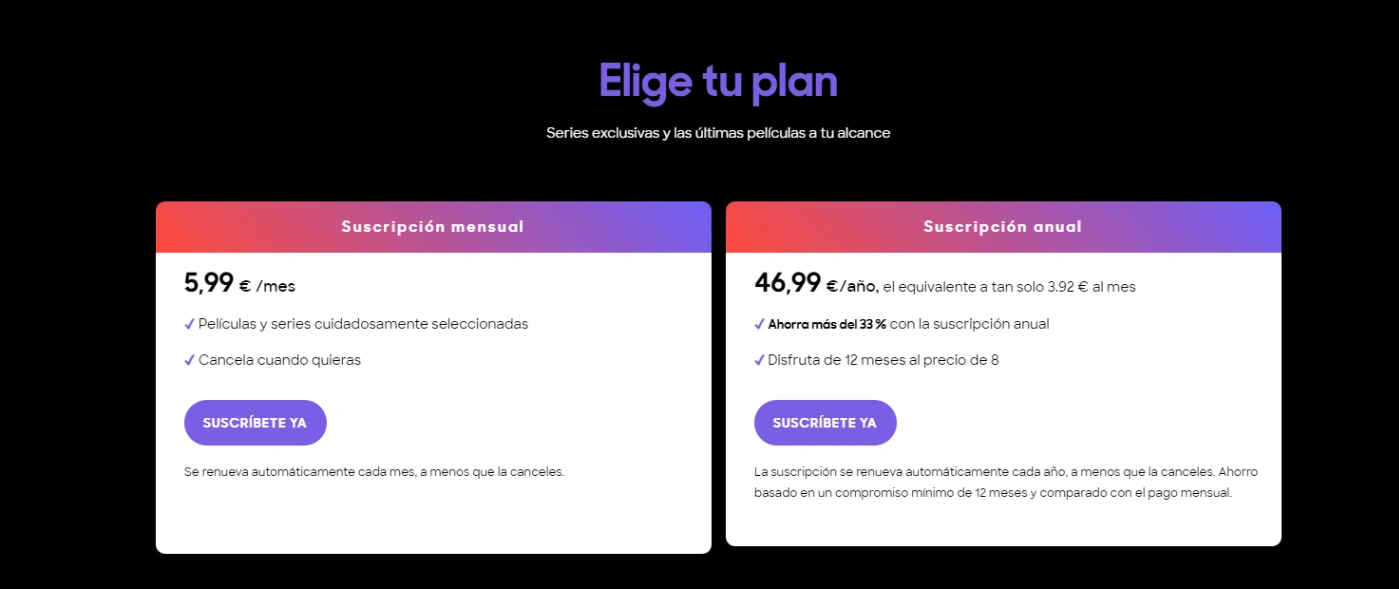

In addition to reviewing your current subscriptions, it's also important to assess whether the ones you frequently use really offer added value. For example, if you have a subscription to a movie and series streaming platform, ask yourself if you really use it enough to justify the monthly cost. If the answer is no, consider canceling it and looking for cheaper alternatives. or free.

Another aspect to consider when choosing your subscriptions is the quality of the content they offer. Not all streaming platforms, digital magazines, or apps are the same. Some may have a wider and more varied selection of content, while others may offer exclusive or high-quality content. Research and compare the available options before making a decision.

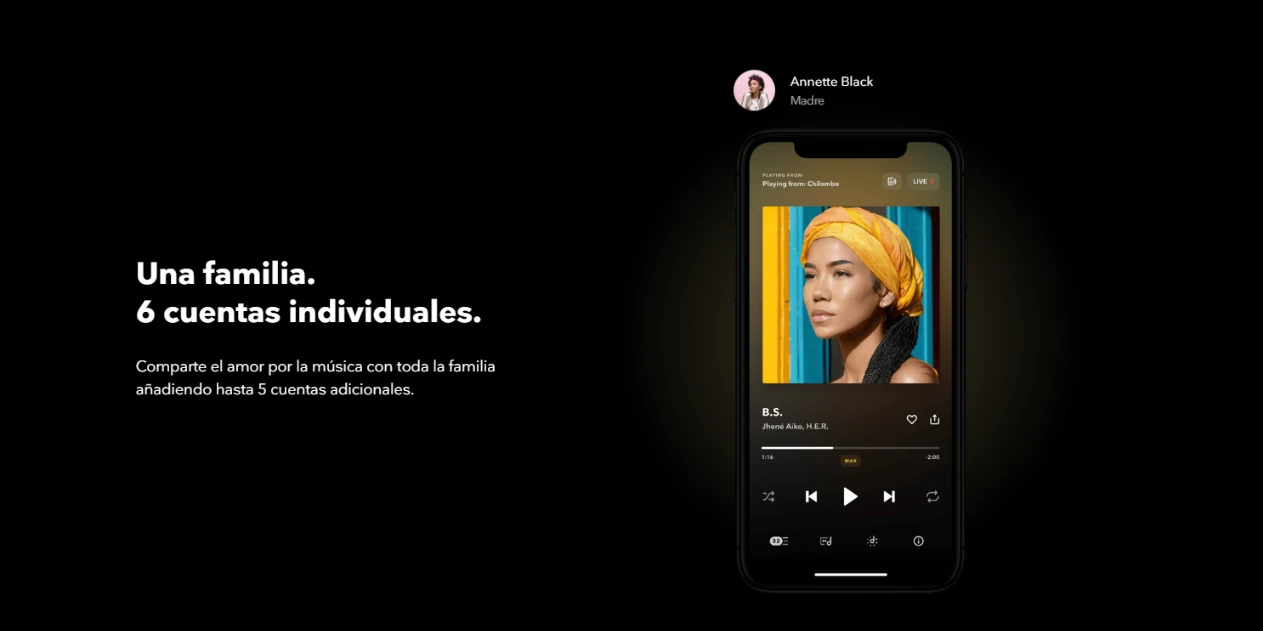

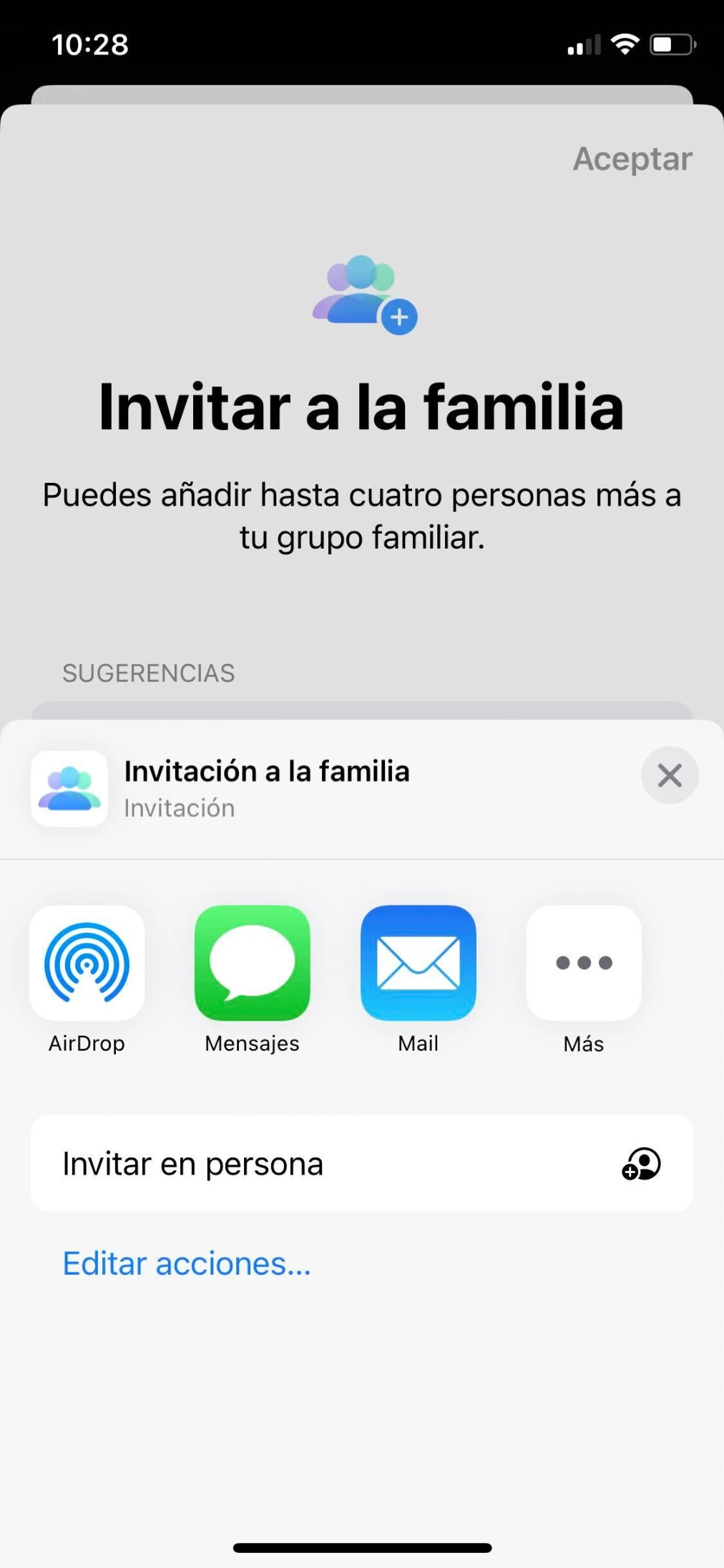

Sharing the cost of subscriptions with Sharingful

If you have close friends or family who also use some of the same services as you, consider sharing the cost of subscriptions. This means that each person will contribute a portion of the monthly payment.

Thanks to Sharingful, it's easy to organize and split subscription costs fairly. For example, if you have a premium subscription to a music service, you can invite your friends to join and split the cost among everyone. This way, you can enjoy the service without having to pay the full fee.

Taking advantage of cashback from some stores

Cashback is a way to save money when making online purchases. Some stores offer a portion of your total purchase as a refund in your account. For example, if you buy an item for 100 euros and the cashback is 5%, you will be refunded 5 euros.

Research which stores offer cashback and take advantage of these offers when making your online purchases. You might not become rich from this, but every little saving counts and can accumulate over time.