Saving strategies for students: All the keys

Despite the fact that student life can be financially challenging, there are several strategies that can help you save money and manage your finances effectively.

Saving strategies for students: All the keys

Saving is an essential skill that we should all learn, and students are no exception. Even though student life can be complicated in financial terms, there are several strategies that can help you save money and manage your finances effectively. In this article, we will provide you with all the keys to saving money as a student.

1. Create a budget

The first step to saving money is creating a budget. This will allow you to keep track of your income and expenses, and will help you identify areas where you can reduce your expenses. Additionally, a budget will help you avoid unnecessary spending and save money for your future needs.

To create a budget, you must first identify your income. This can include your financial aid, part-time job income, and any other income you may have. Then, you need to identify your expenses. This can include tuition fees, books, accommodation, food, transportation, and any other expenses you may have.

1.1. Budgeting Tools

There are several tools that can help you create a budget. Some of these tools are free and some require a subscription. Some of the most popular tools include Mint, YNAB (You Need A Budget), and PocketGuard. These tools allow you to connect your bank accounts, track your spending, and create a budget easily and conveniently.

In addition to these can lead to high interest rates and additional fees if you are not careful.

2. Cut down expenses

Once you have created a budget, the next step is to cut down your expenses. There are several areas where you can reduce your expenses, including food, housing, books, and transportation.

As for food, you can save money by cooking at home instead of eating out. Also, you can save money by buying food in bulk and taking advantage of sales and discounts. As for housing, you can save money by sharing an apartment or a house with other students. As for books, you can save money by buying used books or renting them. As for transportation, you can save money by using public transport or carpooling with other students.

2.1 Tips to cut down expenses

There are several tips that can help you reduce your expenses. One of these tips is to avoid impulse purchases. Before buying something, you should ask yourself if you really need it and if you can afford it. Another tip is to take advantage of discounts and offers for students. Many companies offer discounts and special deals for students, so you should take advantage of these opportunities to save money.

In addition, you should avoid using credit cards unless you can pay the full balance every month. Credit cards They can be useful for emergencies, but they can also lead you to accumulate debts if you do not use them responsibly.

3. Generate income

In addition to reducing your expenses, you can also save money by generating income. There are several ways to generate income as a student, including working part-time, doing freelance work, and selling things you no longer need.

Working part-time can be an excellent way to generate income and gain work experience. However, you must make sure that your job does not interfere with your studies. Doing freelance work can be a more flexible option, as you can work on your own schedule and from the comfort of your home. Selling things you no longer need can be a quick and easy way to generate income.

3.1. Income-generating opportunities for students

There are several income-generating opportunities for students. Some of these opportunities include part-time jobs on campus, tutoring jobs, research jobs, and teaching assistant jobs. In addition, you can generate income by doing freelance work in areas such as writing, graphic design, programming, and translation.

In addition, you can generate income by selling things you no longer need. This may include books, clothes, furniture, and other items. You can sell these items online through websites like eBay, Amazon, and Craigslist, or you can sell them in person through garage sales and flea markets.

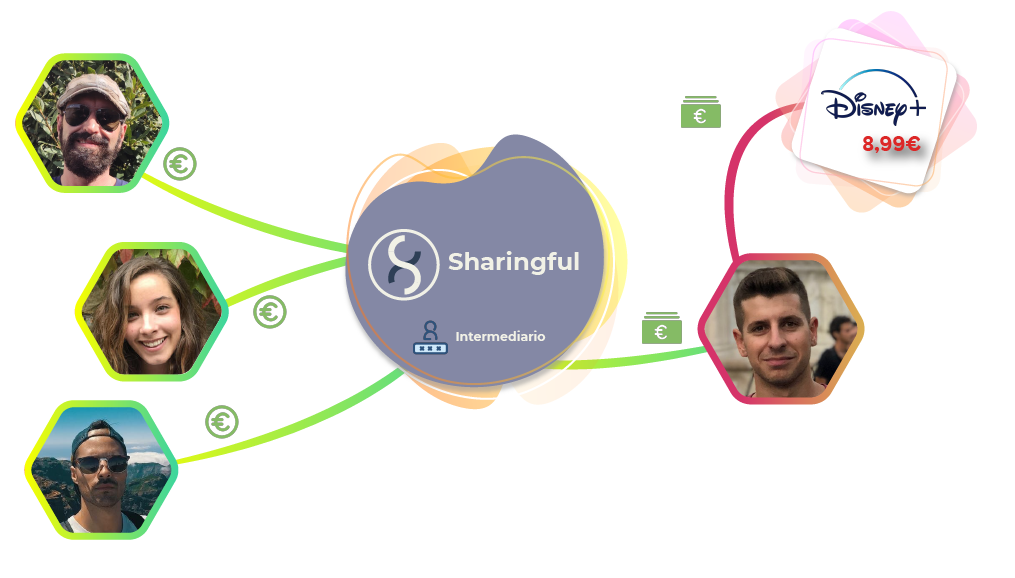

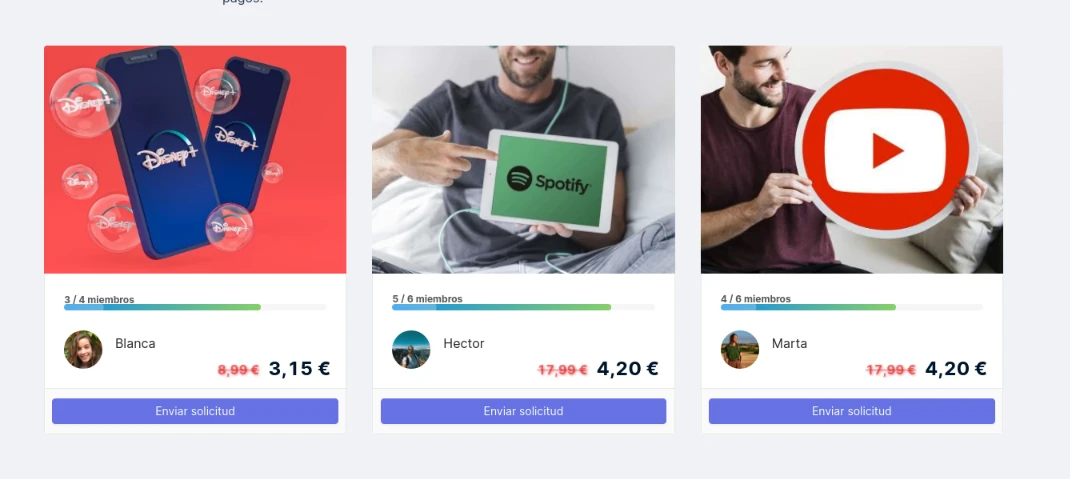

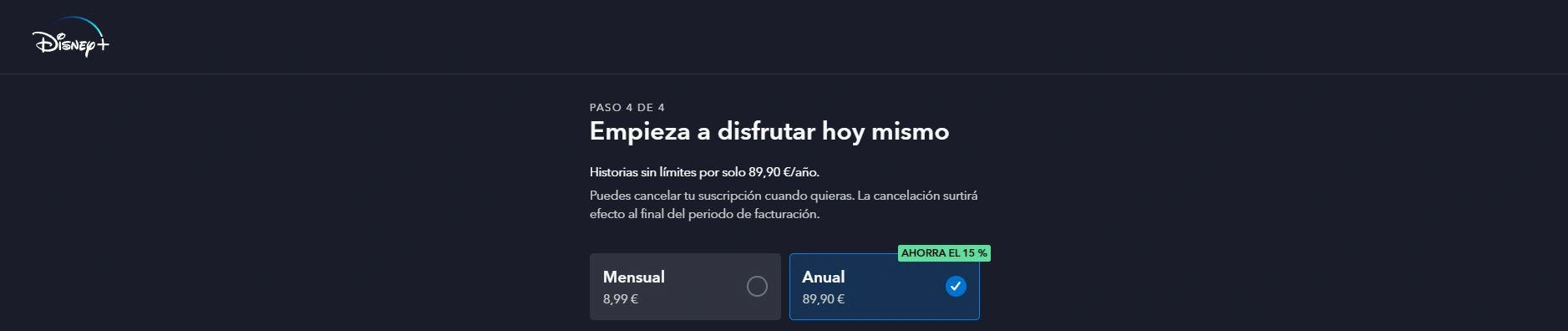

4. Sharing streaming expenses

Currently There are many streaming subscription services. However, the cost of subscribing to multiple platforms can quickly add up, especially for students on a limited budget. An effective strategy for managing these expenses is to share streaming subscriptions.

4.1. Benefits of sharing subscriptions

Sharing subscriptions to streaming services not only reduces the individual cost, but also allows access to a wider variety of content. Many platforms offer family or multi-user plans that are ideal for this purpose, providing several screens or profiles under a single subscription. This means you can enjoy your favorite shows and music while splitting the cost with friends or roommates.

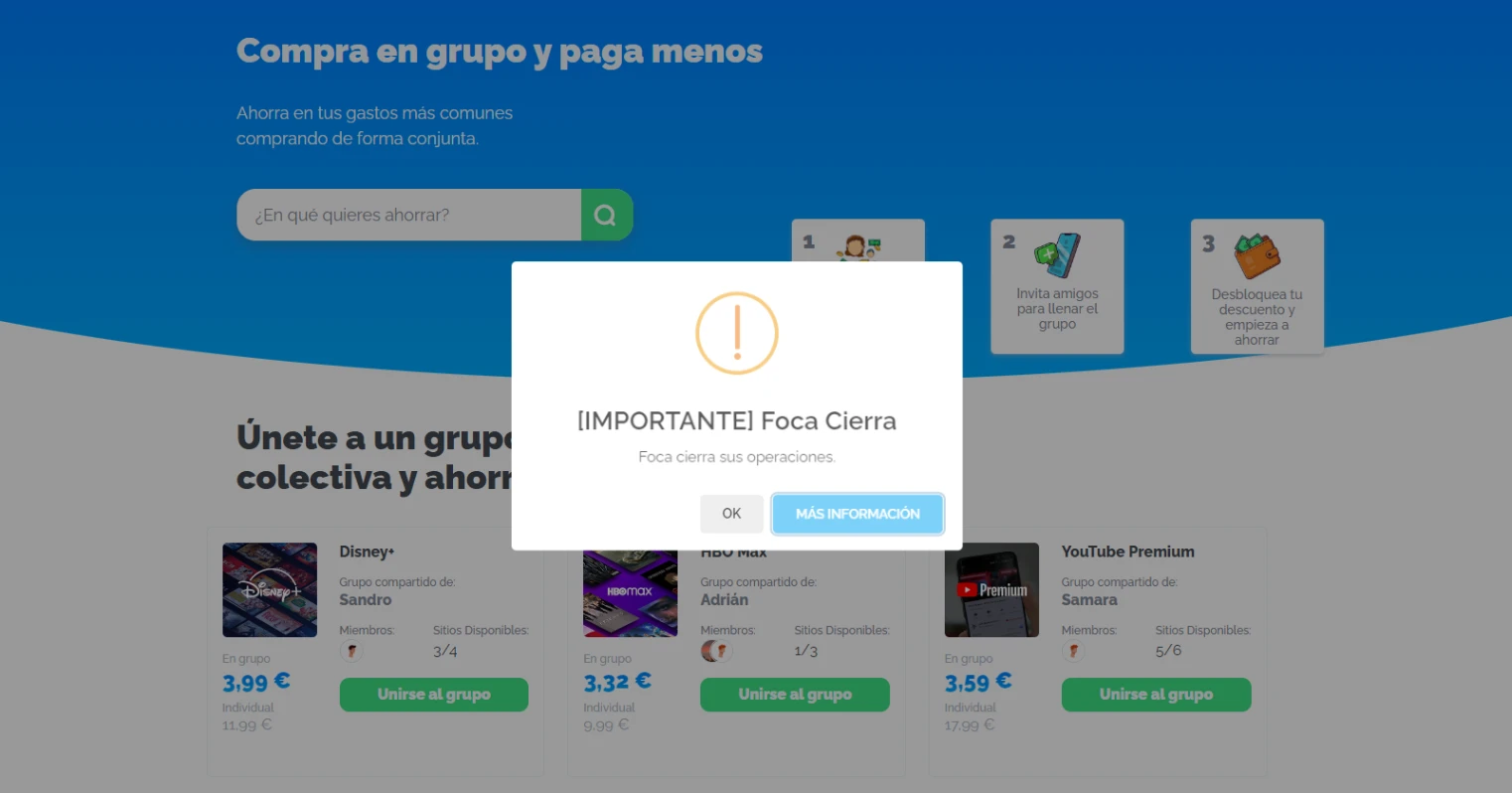

4.2. How to share safely

Although sharing subscriptions is practical and economical, it's important to do it safely. For this reason we recommend using Sharingful.

Sharingful takes care of all the management of sharing the subscription so you don't have to. On the other hand, it also offers you security in payments.

4.3. Popular platforms for sharing

Some streaming platforms that offer family or multi-user plans include:

- Spotify Premium Family: Allows up to 6 individual accounts.

- Netflix: Offers plans with multiple simultaneous screens.

- HBO Max: Allows creating profiles and multiple simultaneous screens.

- Apple Music Family: Up to 6 people can share the plan with individualized access.