Purposes for saving during 2025

By the year 2025, it is essential to consider saving as a priority.

The new year always brings the opportunity to reflect on our finances and set goals that help us improve our economic situation. For the year 2025, it is essential to consider saving as a priority. This article explores the importance of saving, how to set goals, strategies to increase savings, the obstacles we might face, and how to maintain motivation throughout the year.

The Importance of Saving

Saving is a practice that not only involves setting money aside but also holds a deeper meaning in a person's financial life. Understanding why saving is important can be a great motivator to embark on this journey towards financial security.

Definition of Saving

Saving is defined as the portion of income that is not used for immediate consumption. It is allocated for a future purpose, whether to cover emergencies, make investments, or achieve personal goals. It is a strategy that allows for the accumulation of resources and provides a solid foundation for financial planning.

Moreover, saving can be done in various ways: savings accounts, investment funds, or even in cash. The fundamental aspect is that the individual has a system that allows them to visualize their progress and aim to save a specific amount each month.

Benefits of Having a Savings Fund

Having a savings fund provides multiple benefits that go beyond the simple accumulation of money. One of the most significant benefits is financial security. Having a fund allows one to face emergencies without resorting to debt, which can alleviate stress and provide peace of mind.

Another benefit is the possibility of investing. A savings fund can become the initial capital for a business or long-term investments, which could generate additional income. Thus, saving acts as a springboard to new financial opportunities.

Additionally, saving fosters a mindset of discipline and responsibility. By establishing a savings habit, people learn to prioritize their expenses and differentiate between needs and wants. This practice not only improves financial health but also contributes to a more conscious and balanced lifestyle. For example, by saving for a trip or an important purchase, one can enjoy the process and the final result more, knowing that they have worked to achieve it.

Finally, saving can also have a positive impact on mental health. The feeling of having a financial cushion can reduce anxiety related to money and daily worries. This is especially relevant in times of economic uncertainty, where a savings fund can offer a safety net that provides confidence and stability. Thus, saving becomes not only a financial tool but also an essential component of a person's overall well-being.

Setting Savings Goals for 2025

Once the importance of saving is understood, the next step is to set clear and specific goals. These goals not only motivate saving but also help give direction to personal finances.

Identifying Financial Goals

Identifying financial goals is crucial for the saving process. These can vary from person to person but should always be realistic and achievable. Examples of goals include:

- Creating an emergency fund of at least three months' expenses.

- Saving for a dream vacation.

- Raising money for a new house or car.

It is essential that these goals are written down and kept visible to serve as a constant reminder. Budgeting apps can also be used to facilitate this process and easily visualize the progress made.

Additionally, it is helpful to break long-term goals into smaller, manageable objectives. For example, if the goal is to save for a house, an intermediate goal could be to save a specific amount each month. This not only makes the process less overwhelming but also allows for the celebration of small achievements along the way, which can increase motivation and commitment to saving.

Creating an Effective Savings Plan

An effective savings plan should consider monthly income and expenses. The 50/30/20 rule is a good reference: allocate 50% to needs, 30% to wants, and 20% to savings. However, each person can adjust these percentages according to their particular situation.

Automating savings is also key: scheduling automatic transfers to a savings account right after receiving income can ensure that money is saved before it is spent. Additionally, it is advisable to regularly review and adjust the plan to adapt it to financial or life changes.

It is also important to consider the possibility of diversifying savings options. For example, one can explore opening high-yield savings accounts or even long-term investments that offer a higher return. This not only helps maximize savings growth but also provides greater financial security as the set goals approach. Continuous financial education is essential to make informed and strategic decisions on the path to achieving savings goals.

Strategies to Increase Your Savings

Increasing savings can seem challenging, but there are simple strategies that can facilitate this process. Implementing some of these tactics can significantly contribute to your financial goals.

Automatic Saving: A Smart Option

Automatic saving has become one of the most effective strategies to help people reach their goals. By setting up automatic transfers from the current account to the savings account, the temptation to spend that money is avoided. When it is not available for immediate consumption, it becomes easier to save.

Additionally, many banks offer options to round up purchases and add that change to savings, which, although it may seem small, can add up significantly over time.

Reducing Unnecessary Expenses

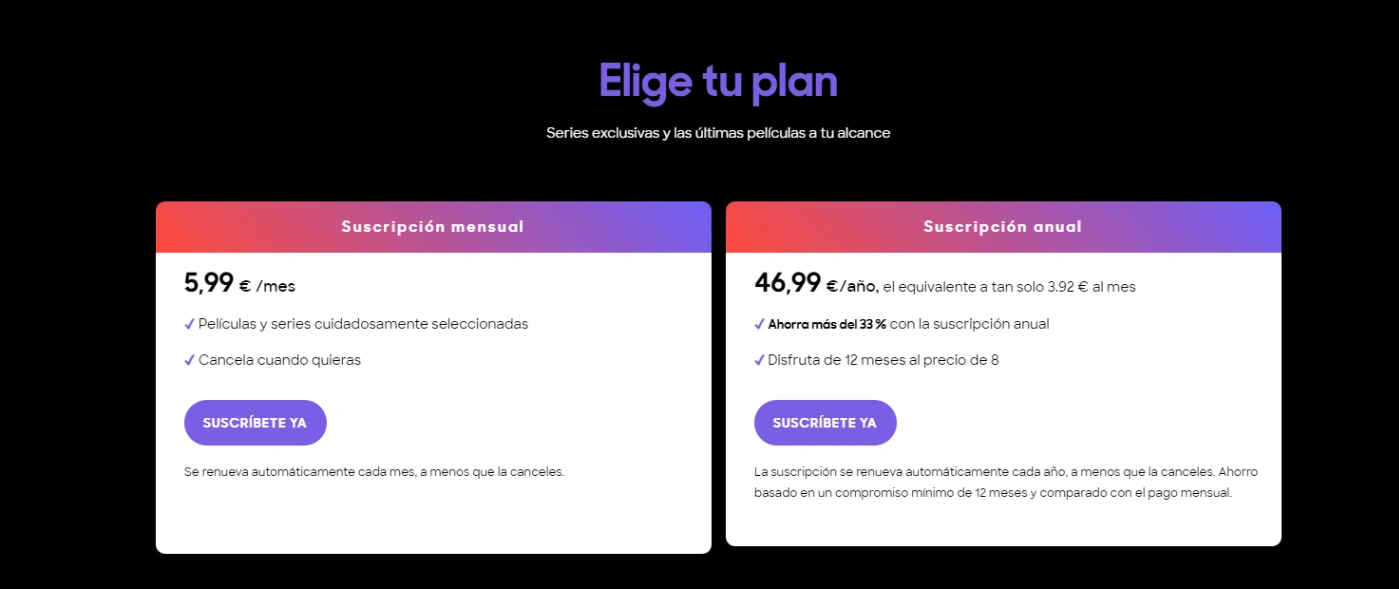

Another effective approach to increasing savings is reducing unnecessary expenses. This involves reviewing consumption habits and getting rid of superfluous expenses. Some tips include:

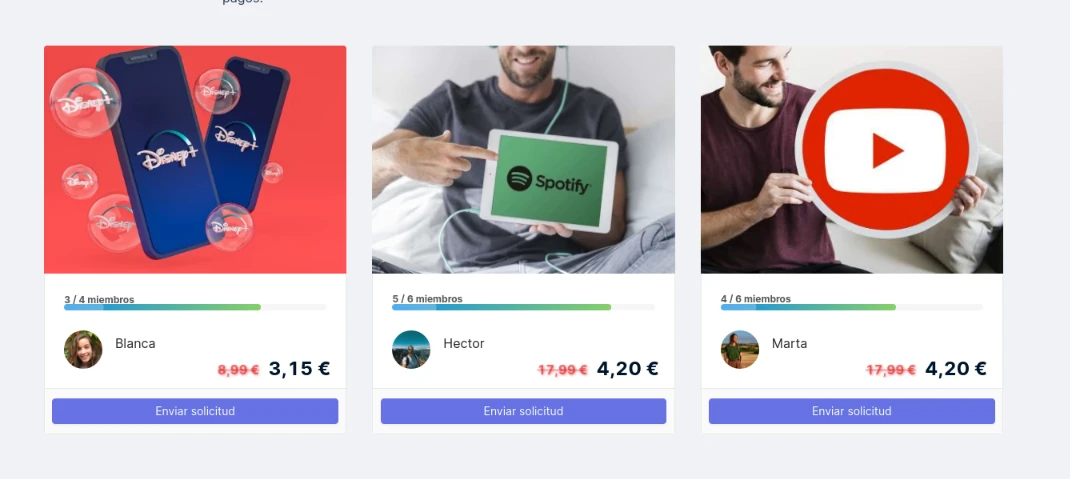

- Conducting a monthly evaluation of subscriptions: cancelling those that are not really used or using Sharingful to share the cost with others.

- Shopping at discount stores or looking for promotions and coupons before making purchases.

- Preparing meals at home instead of eating out, which can have a significant impact on the monthly budget.

- Using apps like TooGoodToGo, Sharingful, BlaBlaCar.

By reducing these expenses, the money saved can be allocated to the savings account, allowing for positive growth in the family economy.

In addition to these strategies, it is essential to establish a clear budget that allows you to visualize your income and expenses. A well-structured budget not only helps identify areas where you can save but also gives you a sense of control over your finances. Consider using financial management apps that facilitate tracking your expenses and send reminders about your savings goals.

Finally, it is important to remember that saving should not be seen as a sacrifice but as an investment in your future. Every small effort counts, and over time, those savings can become a significant fund that allows you to achieve larger goals, such as buying a house, travelling, or even securing a comfortable retirement. The key is to be consistent and maintain a positive mindset towards your finances.

Overcoming Obstacles to Saving

Despite the best intentions, obstacles can arise that make saving difficult. It is important to anticipate these challenges and have a plan to face them.

Managing Debts and Financial Commitments

One of the most common obstacles to saving is the burden of debt. High levels of indebtedness can consume a large part of income, leaving little room for saving. The best strategy here is to prioritize debt reduction.

Establishing a payment plan, whether through the avalanche or snowball method, can help eliminate debts effectively. With fewer debts, the ability to save will increase over time, allowing for greater financial control.

Facing Economic Setbacks

Economic setbacks are another common reason why people cannot save. These can include medical emergencies, home repairs, or job loss. To minimize the impact of these situations, it is essential to have an emergency fund, as mentioned earlier.

This fund acts as a financial cushion that allows for handling setbacks without affecting planned savings. Additionally, maintaining a disciplined approach and prioritizing saving will help navigate economic problems that may arise during the year.

It is also important to consider financial education as a key tool to face these obstacles. Learning about money management, investments, and savings strategies can empower people to make more informed decisions. There are numerous resources, from books to online courses, that can provide the necessary knowledge to improve personal financial health.

Furthermore, creating a monthly budget can be an effective technique to visualize income and expenses. By identifying areas where spending can be reduced, money can be freed up for saving. Discipline in following the budget is essential, as it allows for adjusting consumption habits and prioritizing long-term savings, which can result in greater financial stability in the future.

Maintaining Motivation to Save

Motivation is key to maintaining a saving habit. Often, discipline can waver, especially if immediate results are not being seen. Here are some ways to stay motivated.

Celebrating Small Financial Achievements

Celebrating achievements, no matter how small, is crucial to maintaining motivation. Every time a goal is reached, it is important to acknowledge it and reward oneself in some way. This could be a small treat, going out to dinner, or simply sharing the news with friends and family.

These celebrations reinforce positive behaviour and encourage continued saving in the future.

Maintaining Discipline in Your Finances

Finally, to maintain long-term motivation, it is essential to maintain discipline in finances. This means following the savings plan, avoiding financial distractions, and being mindful of consumption habits.

Regularly reviewing progress towards goals can also provide a clear view of the advances made. Creating a calendar with financial milestones can help mark the path to success and remind you that every small step counts.

Additionally, it is helpful to remember that saving is not just about accumulating money but about building a more secure and stable future. By establishing an emergency fund, for example, one can face setbacks without falling into debt. This type of financial preparation not only provides peace of mind but also reinforces the motivation to continue saving, as saving is seen as a tool for financial freedom.

On the other hand, sharing your savings goals with a support group or friends can be an excellent way to maintain motivation. Having others who encourage you and keep you accountable makes it more likely that you will stay on the right track. Social media can also be a valuable resource, where communities can be found that share tips, experiences, and celebrations of financial achievements. This creates a sense of camaraderie and can inspire others to follow the same path towards a healthier financial life.